What's Included

in your tax app?

-

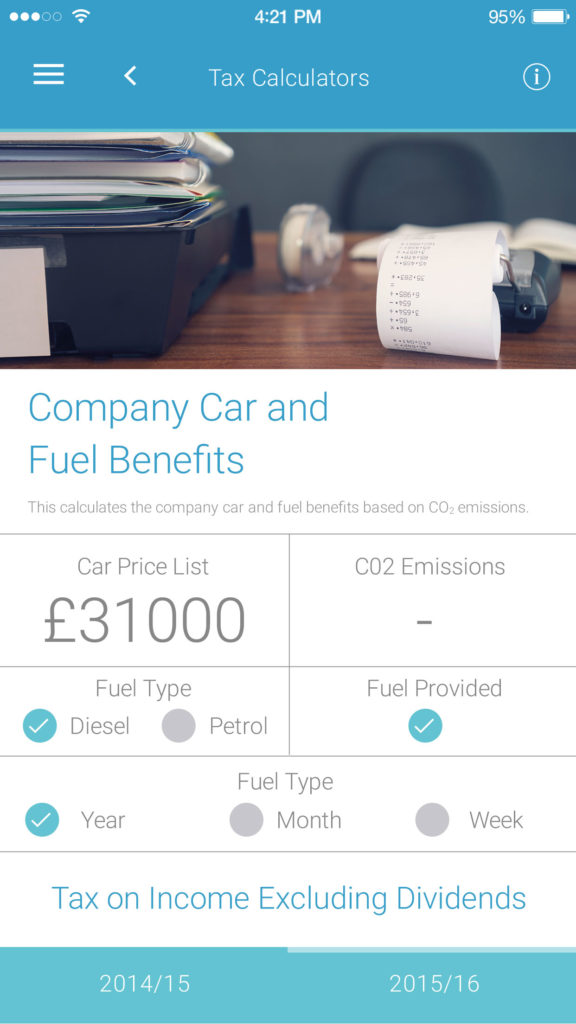

Interactive calculators covering two financial years, to help your clients make informed decisions.Calculate dividends payments, SDLT, Pensions relief, inheritance tax, VAT, Corporation tax, Loan and mortgage repayments, Company car and fuel benefits, and more.

-

A range of tax rates with supporting explanatory text, written in an easy to understand format.Rates include Capital Gains Tax, Corporation tax rates, car fuel benefit, income tax rates, Land and Buildings Transactions Tax, SDLT, capital allowance and more.

-

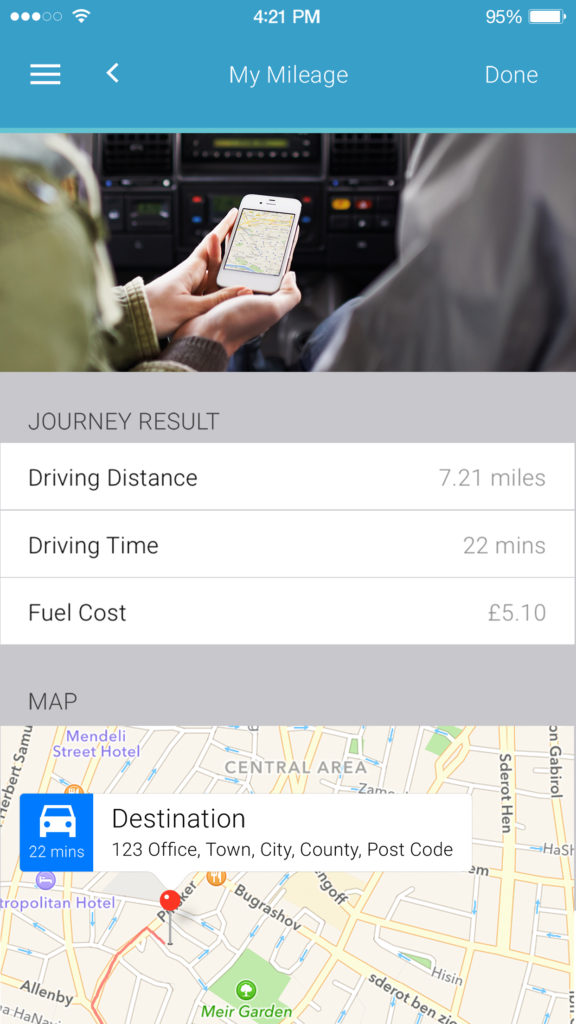

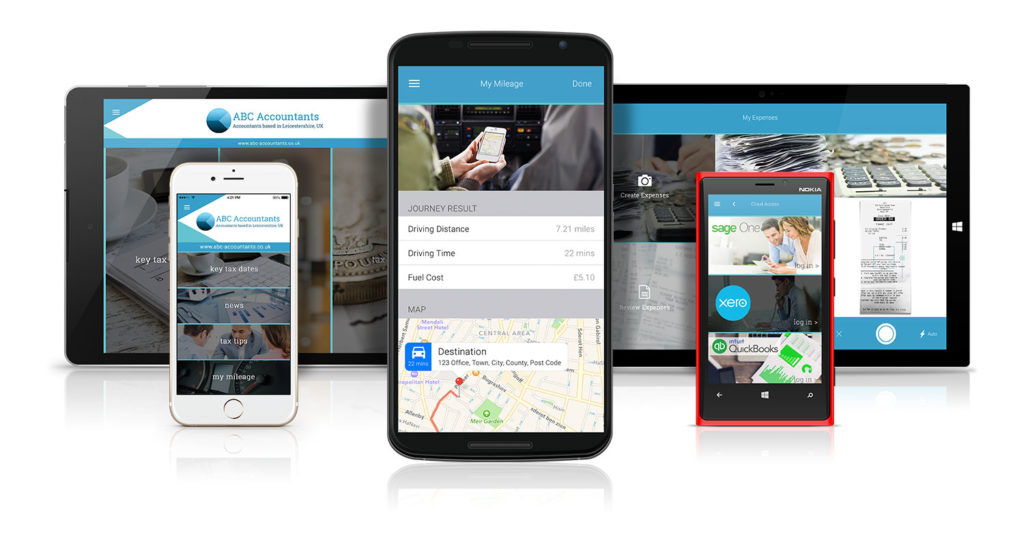

Map your journey and easily calculate your mileage.With integrated Google Maps software and the option to calculate Petrol, Diesel and Electric car costs, clients will be fully supported when they travel.

-

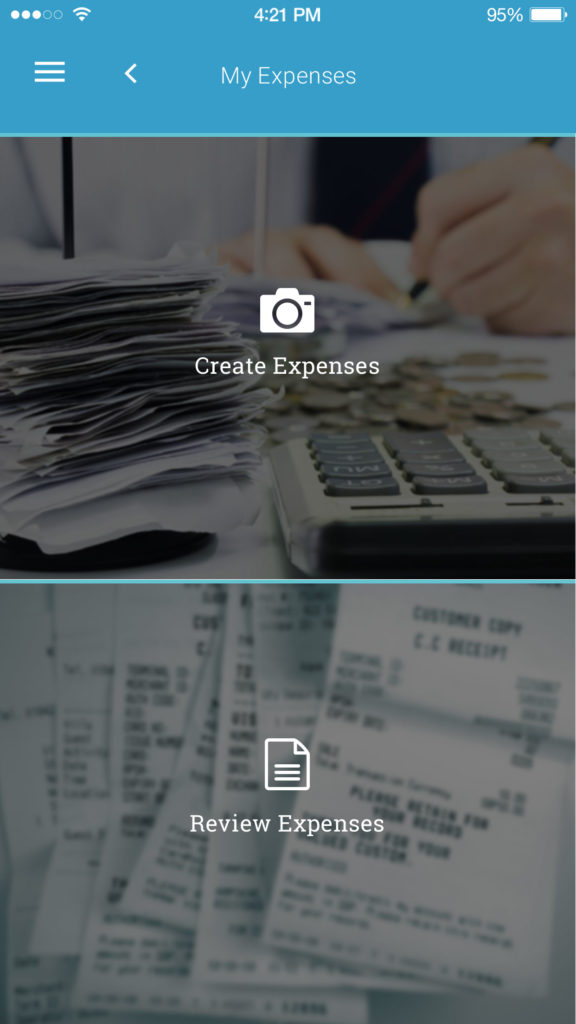

Scan receipts, categorise and export expenses to eliminate paperwork.All of your clients’ expenses in one place. Includes the option to export to an email, PDF, message and integrate with using apps such as Dropbox.

-

Informative tips and checklists for business and personal tax advice.

Easy to understand tax explanations, checklists and tips covering topics such as Capital Gains Tax, inheritance tax planning, taxation of the family and more.

-

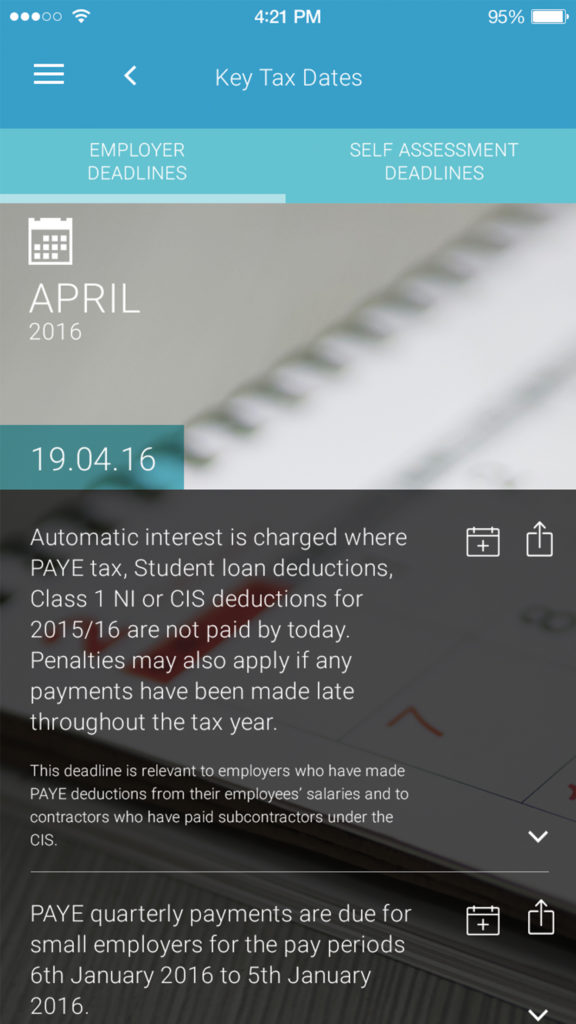

A tax calendar covering all upcoming deadlines, with supporting details on who will be affected.

All dates can be added to the device’s calendar with one click and shared via email, message, social media or other integrated apps.

-

Give your clients easy access to the cloud accounting software available in your firm.

One section of your app, with an unlimited amount of portals to ensure that your clients always have access to their files, wherever they are.

Staying connected

with your clients

Maximise your taxapp launch - marketing materials included

All aspects of your marketing plan is covered, including website content, email text, suggested social media posts, images of your app and more. We’ll also provide you with a guide on ‘How to promote your taxapp’ before your launch date so you have everything ready for the big day.

Promote your firm to new and existing contacts

Add information about your services and team to show off the great ways you help your clients. We can also integrate your blog or news page so your taxapp users are always aware of latest developments from your firm, and a quick contact page so your contacts can speak to you at the touch of a button.

Always the latest information

With over 40 years’ experience delivering high quality content to accountancy firms in the UK, our experts will regularly update the content within your taxapp so your clients always have access to correct information when they need it.

Push Notifications

Send push notifications to all of your contacts’ devices at the same time.

Update your clients on the latest news, services and blog posts available from your firm. For those with notifications turned off, all messages will be easily accessible in the notification centre of the app.

A modern, intuitive design, tailored for your accountancy firm

We use the latest design features to ensure your taxapp is consistent with your firm’s branding, and exceeds your expectations. With an easily accessible slide menu, your clients will be able to find the information they require in seconds.

To see all of this in action, then take a look at our app.

Make sure your clients can always find you

Available in the App Store, Google Play and as a WebApp, your taxapp can be accessed on any device.

Buy now

*You will need to have Google and Apple developer accounts for the taxapp. If you already have developer accounts, you can use them. If you don’t, you will need to set them up following out guides here: https://www.mytaxapp.co.uk/getting-started/. There is a small set-up fee to Google, which is a one-off payment of £25. In addition, Apple have a subscription fee of $99 per year. The developer accounts give you full control and access to all the existing apps you have. The minimum term for the taxapp is 24 months.

Find out more

0330 058 7141

info@mytaxapp.co.uk